- Government Plans to Bridge the Gap with Reforms and Cash Transfers

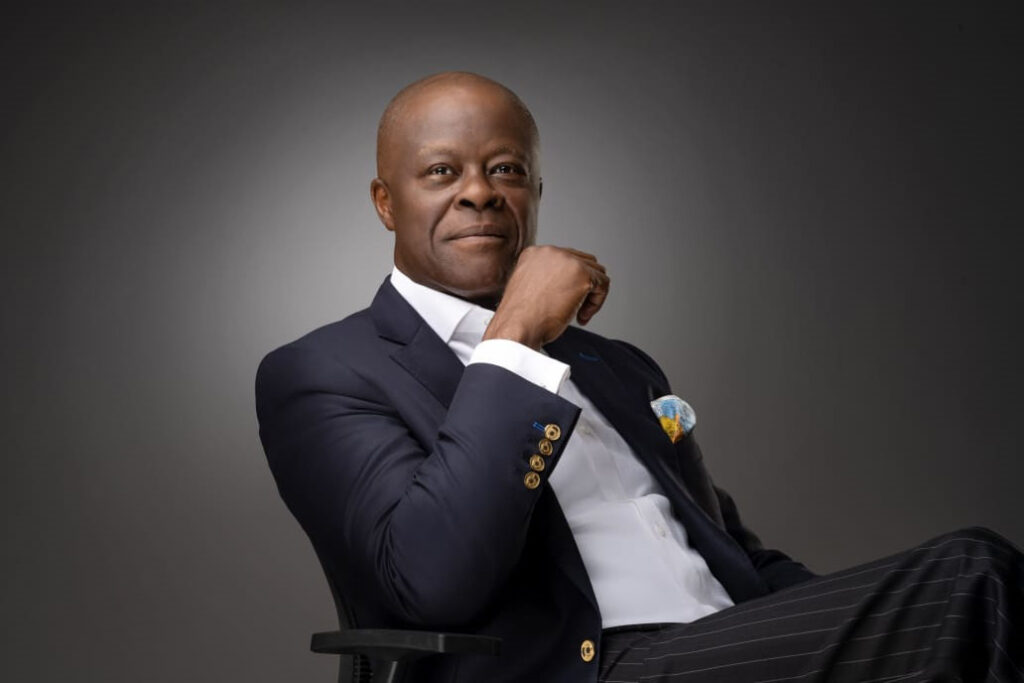

A recent statement by Nigeria’s Finance Minister, Wale Edun, has shed light on the significant wealth disparity in the country.

During an interview with Channels TV, he revealed that only an estimated 5% of Nigerians have more than ₦500,000 in their bank accounts. This statistic highlights the stark economic realities faced by millions of Nigerians, where a vast majority struggle to make ends meet.

Government Aims to Rectify Imbalances in the economy

Minister Edun emphasized that the government is committed to addressing these economic imbalances. He explained that the current reforms aim to rectify the situation where “liquidity in the economy that is not tied to production or supply of goods and services” has disproportionately benefited a small elite group. These reforms, he stated, are designed to “mop up” this excess liquidity and ensure that government revenue is directed towards the treasury.

Palliative Measures and Support Programs

Recognizing the challenges faced by ordinary Nigerians, the government has announced several measures to alleviate poverty and address the high cost of living. President Tinubu’s administration plans to distribute a palliative package of ₦25,000 to 15 million households over the next three months. This translates to ₦75,000 per household. Of what good this will be in a nation where inflation in on a steady rise is yet to be highlighted.

Furthermore, the government plans to provide grants to artisans, traders, and small business owners to boost their livelihoods.

Ensuring Transparency and Targeting

Minister Edun acknowledged concerns about transparency and targeting in such programs. He assured the public that the system for these intervention programs and payments has been revamped to ensure the funds reach the intended beneficiaries. This includes requiring beneficiaries to have a NIN (National Identification Number), BVN (Bank Verification Number), or access to a mobile money account. These measures aim to prevent fraud and ensure that the support reaches those who need it most.

Road Ahead

The revelation of Nigeria’s wealth disparity highlights the need for urgent action to address economic inequality. The government’s proposed reforms and support programs offer a potential step towards a more equitable and inclusive economy.

[READ ALSO] Investors Return to Nigeria: Capital Inflows Jump 66% in Q4 2023

While these initiatives represent positive steps towards bridging the wealth gap, challenges remain. Implementing such large-scale programs effectively requires robust infrastructure, efficient administration, and minimal corruption. Additionally, addressing the root causes of poverty, such as limited job opportunities and inadequate access to education and healthcare, needs continued focus.

Despite the challenges, the government’s commitment to tackling economic inequality is commendable. By ensuring transparency, accountability, and effective implementation of these programs, Nigeria can move towards a more equitable and prosperous future for all its citizens.