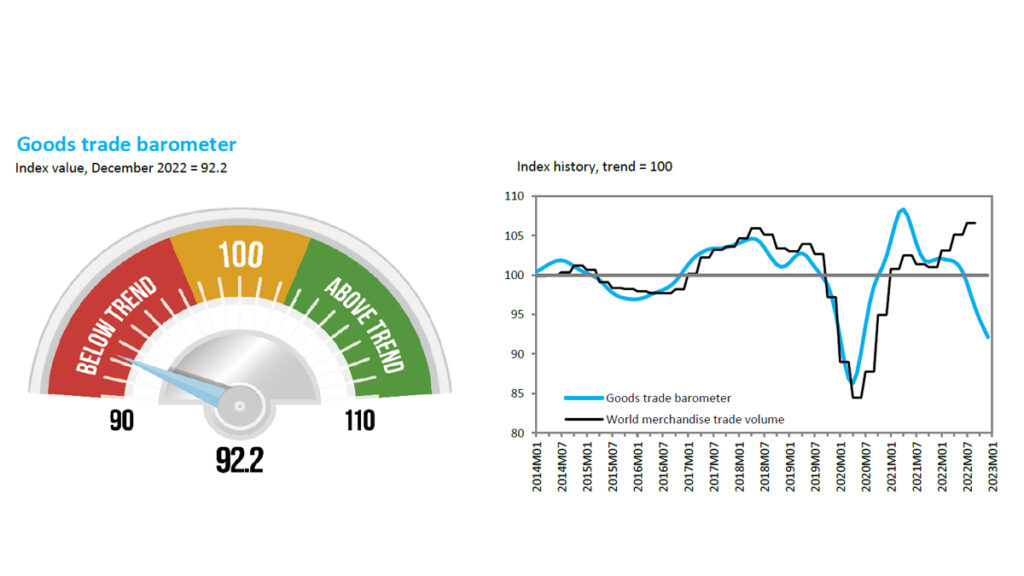

CEM REPORT, TRADE | World Trade Organization barometer index has fallen further to 92.2 from 96.2 in the previous release and well below the baseline value of 100 indicating a to weakening trade growth in volume terms. This is shown in the latest WTO Goods Trade Barometer issued on 1 March.

According to WTO, world merchandise trade growth by this reading is a strong sign of weakness in the fourth quarter of 2022 and is likely to remain weak in the first quarter of 2023.

The Goods Trade Barometer is a composite leading indicator for world trade, providing real-time information on the trajectory of merchandise trade relative to recent trends. Barometer values greater than 100 signal above-trend trade volume while values less than 100 suggest that goods trade has either fallen below trend or will do so in the near future. The barometer index (represented by the blue line above) also finished below the merchandise trade volume index (represented by the black line), which stood at 106.6 in the third quarter thanks to resilient exports in Europe and the Americas. Preliminary data suggest that the merchandise trade index will follow the barometer index down once quarterly trade volume statistics for the fourth quarter are released.

The volume of world merchandise trade was up 5.6% in the third quarter of 2022 compared to the same quarter in the previous year. Meanwhile, cumulative year-on-year growth for the first three quarters of 2022 stood at 4.4%, above the WTO’s forecast released last October of 3.5% for the whole year. A downturn in the fourth quarter would bring actual trade growth more in line with the WTO’s forecast for 2022. Any slowdown may prove to be short lived since container throughput of Chinese ports and new export orders from Purchasing Managers’ Indices (PMIs) have already started to pick up.

[READ ALSO] Nearly 500 Children Killed in Ukraine, $4 Billion Needed to Support More than 11 Million People

All of the barometer’s component indices have fallen below trend except for the automotive products index (105.8), which was buoyed by above-trend sales and production figures for the United States, Europe and Japan, outweighing declines in China. The export orders index (97.4) remains below trend but is rising, hinting at a possible upturn in the near future. On the other hand, indices for container shipping (89.3), air freight (87.8), electronic components (84.9) and raw materials (92.0) are all below trend and declining, suggesting that weakness in trade is broad-based, impacting many sectors.